The squeeze is just beginning:

… there was Dallas’s mayor, Michael S. Rawlings, testifying this month to a state oversight board that his city appeared to be “walking into the fan blades” of municipal bankruptcy.

“It is horribly ironic,” he said.

Indeed. Dallas has the fastest economic growth of the nation’s 13 largest cities… Hundreds of multinational corporations have chosen Dallas for their headquarters…

But under its glittering surface… The city’s pension fund for its police officers and firefighters is near collapse and seeking an immense bailout.

Over six recent weeks, panicked Dallas retirees have pulled $220 million out of the fund. What set off the run was a recommendation in July that the retirees no longer be allowed to take out big blocks of money. Even before that, though, there were reports that the fund’s investments — some placed in highly risky and speculative ventures — were worth less than previously stated.

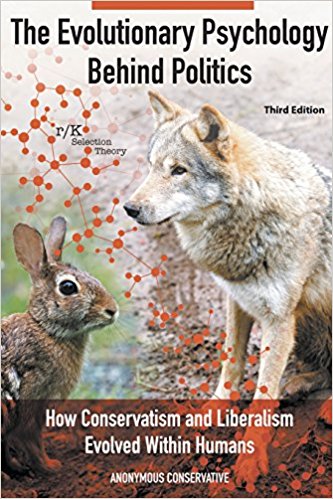

What that is, is the beginning of the K-psychology entering the picture in an r-selected environment. Part of the population is still r, and is assuming their money will always be there. But in reality the funds are limited, and the K-strategists, by pulling out their money now, are both securing superior survival rates in the future, and triggering the collapse of the system which will bring back full K-selection.

Now, the Dallas Police and Fire Pension System has asked the city for a one-time infusion of $1.1 billion, an amount roughly equal to Dallas’s entire general fund budget but not even close to what the pension fund needs to be fully funded.

Can you imagine? $1.1 billion, just for police and firefighters, just in Dallas, and it is not even close to what it is really short. That is just to keep things afloat for a few years, maybe – in that small pension system. The national debt, the credit card debt, student loan debt, personal debt, corporate debt, state debt, municipal debt, real estate bubbles, other pension funds, and on and on. The entire system is awash in debt, and just waiting for the trigger.

“The City of Dallas has no way to pay this,” said Lee Kleinman, a City Council member who served as a pension trustee from 2013 until this year. “If the city had to pay the whole thing, we would declare bankruptcy.”

Right now, it is unimaginable we would cut social security, send dying people to the curb by slashing welfare, eliminate food stamps, or even not pay retired firefighters or cops their pensions. It is impossible to even conceive of leaving all those people just hanging. Today, you can always find the money somewhere.

And yet, there is a reality out there where you can’t create money you don’t have. There is a reality where as much as you want to save a life, treat an illness, or honor a promise to take care of someone in their old age in return for service in their youth, the money just isn’t there. We have yet to see that reality, but it appears to rapidly be approaching.

… in fact, the fuse was lit back in 1993, when state lawmakers sweetened police and firefighter pensions beyond the wildest dreams of the typical Dallas resident. They added individual savings accounts, paying 8.5 percent interest per year, when workers reached the normal retirement age, then 50. The goal was to keep seasoned veterans on the force longer…

Back in Dallas, the pension trustees set about trying to capture the 9 percent annual investment returns. They opted for splashy and exotic land deals — villas in Hawaii, a luxury resort in Napa County, Calif., timberland in Uruguay and farmland in Australia, among others.

The projects called for frequent on-site inspections by the trustees and their plan administrator, Richard Tettamant. The Dallas Morning News reported that officials were spending millions on global investment tours, with stop-offs in places like Zurich and Pisa, Italy. Pension officials argued that their travel was appropriate and their investments were successes.

It was an investment right in Dallas that led to the pension fund’s undoing: Museum Tower, a luxury condominium high rise…

Museum Tower started out modestly, with a $20 million investment from the pension fund. But as the downtown Arts District flourished, the pension fund raised its stake, then doubled the height of the building, and finally took over the whole development for $200 million.

“We all know some of the benefits, guaranteed, were just probably never realistic,” he said. “It was good while it lasted, but we’ve got some serious financial problems because of it.”

All high rabbitry. Expectation of free resources, inability to foresee adverse outcomes, addiction to pleasure, and inability to succeed in a world of limited resources. The guy even says, of all the lives he ruined, “It was good while it lasted, but we’ve got some serious financial problems because of it.” He still doesn’t grasp that the whole thing is a total disaster. He still thinks this wasn’t really a loss. It is just a temporary inconvenience, which will pass harmlessly.

The rabbits will always be the end of everything.

If you understand r/K Theory, you can understand the entire world’s future

[…] Dallas Pensions Need $1.1 Billion, And It Is Not Even Close To Fixing Things […]

This fills me with rage. I see the ‘public servant’ unions extorting booty from the taxpayers’ largesse, with no admission of how luxurious their sinecures already are, and the only fantasy that offers my mind relief involves the rending of flesh from bone.

Weird thing is, I’m not even a proletariat peasant, I’m an educated and exalted ‘professional’. But I’m just fed up with this shit already.