Julian Robertson, the legendary hedge fund manager behind Tiger Management, thinks central banks are fueling bubbles throughout financial markets.

“We don’t have negative rates here in the States yet, but I think it’s tragic that we’ve taken rates down this far,” Robertson said this week at Bloomberg’s Surveillance Primetime event. “I know the Federal Reserves all over the world are trying to ensure prosperity, but in doing so I think they are ensuring a huge bubble, which will be pricked, and we will all be hurt by it.”

Negative and near-zero interest rates from central banks have allowed increased borrowing…

…it would seriously affect financial stocks because banks are holding so many negative-yielding bonds, and the chaos would carry “over to real estate” when the bubble pops. In other words, there are risks wherever investors look.

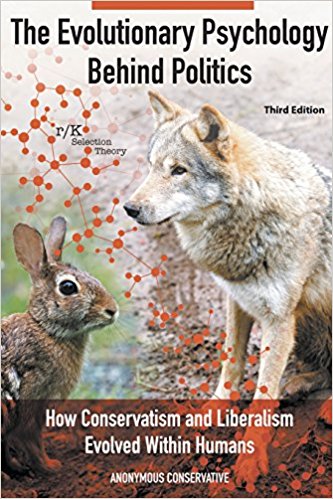

Bubbles are inherent to r-selection, as bubbles require an enormous amount of investible wealth to start, a reduced need to depend on regular income so it may be invested, and a psychology prone to ignore risk and assume a glut of free resources is naturally to be expected. So long as the risk-blindness holds, all of that will combine to create artificial perceptions of an even bigger glut than already existed, and that will feed the psychology that makes the bubble swell even more.

I am not sure bubble is the right term today though, given the rapid increase in the conservative ideology. Bubble implies r-selection. This is more like a parachute covering everything, being held up in three or four places by some tall people who haven’t eaten in two weeks, and most of the population is realizing they will give up shortly, and the whole thing will go down.

This is, in a way, the harshness we should have endured for five or six years back under Reagan, added to similar periods of harshness we should have endured a few times since then, and all of it compounded with interest. Reagan forestalled the harshness Carter should have inflicted on us with debt-spending. Bush I managed to use the Gulf War to justify even more debt spending that kept it off his watch. Clinton enjoyed the benefit of the internet creating the Dot-com bubble in addition to debt spending, until Bush II who used the War on Terror to tap the federal debt even more, taking Federal debt from about $3 Trillion to $9 Trillion. Of course Obama outdid them all, taking Federal debt to almost $20 Trillion.

All of that has delayed a process that is guaranteed to be worse and last longer when it finally happens.

And it appears to be getting closer.

[…] Julian Robertson Sees Bubbles Everywhere […]

At what point is the American debt considered “out of control” and we become semi- or officially insolvent?

Supposedly, $24 Trillion is it. But if they inflated enough, that might not be true, and the bottom line is I assume all the numbers now are rosey bullshit numbers anyway.

julian-robertson-sees-bubbles-everywhere.

davecydell sees bubbles everywhere.

AC says: And it appears to be getting closer.

Fred Reed wrote just yesterday: In the long run, it may not be a good thing. In the short run, it may not be a good thing. The run, I suspect, is getting shorter.

http://www.zerohedge.com/news/2016-09-30/furious-rick-santelli-rages-janets-jawboning-please-dont-help-anymore

Sadly, this is the reason that as much as we want Trump to win, his actions will fix things for a time, maybe even make them quite good. This will forestall the reckoning culturally and economically. I see a Trump presidency as a quasi-Reagan meets General Patton with the moral authority of new deal Roosevelt. If he has two terms, we could literally see a baby-boom and 1950’s/early sixties redo with high technology. This will of course lead to another set of 1968’ers and an r-fest never to be rivaled again. Americans would never have a full day of reckoning for the r-ification of the last four decades of the 20th century. A one term Trump would merely delay the inevitable while the fundamentals of economy and culture get worse and more intractable. Perhaps we can save the country by making it worse as quickly as possible so that r-ism is visible for everyone to see plainly. Every time you save an organization without making its problems apparent, you enable the evildoers to hide their failing and claim ownership of the new success.